UCP, Inc (UCP) is a west coast land developer / homebuilder that recently completed its IPO just over a week ago hitting the public market after the close of business on July 17th. The IPO priced at $15 per share, which was at the low end of the expected range of $15 - $17 per share. The IPO hit the market at an inopportune time, as the frenzy and fear over rising interest rates was at a fever pitch with its greatest impact being felt by housing related names. Since the time of the IPO, shares of UCP have traded down to about $14 per share. The opportunity for investors to profit from an investment in this company is due to multiple discrete items. In my opinion, the upside opportunity from an investment in UCP is greater than any other name tied to real estate today. The homebuilders have rallied significantly from their record lows set over a year ago. Housing and material supply companies are the same story. I believe the market does not currently understand how to price UCP. Is it a homebuilder or a land developer? This uncertainty from a pricing standpoint leads to a price-to-book valuation that is half the level seen by some of the most fairly valued homebuilders today. I would argue that UCP will enjoy the benefits of its startup homebuilding operation and how this side of the business will most likely double annually for years to come. From the land side of the business, the company owns more than enough land to fuel its homebuilding operation. This land was also acquired at dirt cheap prices, and the funds raised from the IPO will allow UCP to develop its land holdings and continue to sell certain developed lots to other builders for significant profits. At the end of the day, this is a company with cheap land, minimal fixed costs, and more than enough cash to grow aggressively or weather any type of correction in the real estate market. I do not feel like a correction will come, and I see the potential for over 50% upside in the near term for UCP.

Company Background

UCP was formed in 2004 and was acquired by PICO Holdings (PICO) in 2008. The story for UCP really begins with its acquisition by PICO, and access to capital that the acquisition provided. Since 2008, UCP has acquired over 6,000 single-family residential lots while investing over $200M. The vast majority of the land acquired and owned today is in Northern California, with a smaller concentration of land holdings in the Puget Sound area of Washington state.

In 2010, UCP launched its homebuilding operation, Benchmark Communities. Today, the company owns and controls over 5,000 lots across 48 communities. There is a significant amount of importance to that last point. On average, each community owned or controlled by the company is comprised of just over 100 lots (~5,000 lots / 48 communities). This is critically important as the company owns communities that can be quickly monetized as opposed to those with hundreds of lots, and have a short tail to them which reduces the holding risk for those who are concerned about a real estate correction.

UCP sold ~7.8M shares as part of the IPO, which priced at $15 per share, raising ~$117M prior to offering costs or any additional proceeds from the underwriters option to purchase up to slightly over another 1M shares. The amount of shares sold as part of the IPO equaled the equivalent of 42.3% of the outstanding ownership interest in the company. Without consideration for the underwriter option to purchase additional shares, this should leave a total of ~18.3M shares outstanding at this point (7.75M shares issued / 42.3% ownership interest). With a current share price of ~$14 per share, the total market capitalization for UCP is ~$255M.

The Investment Opportunity

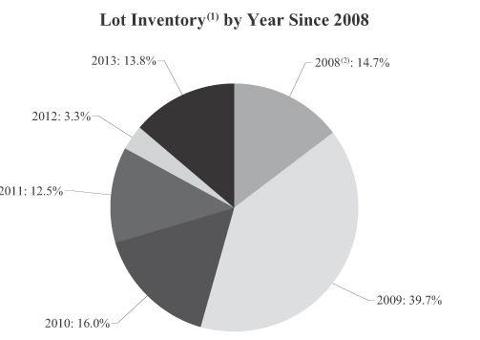

There are two parts to the investment opportunity. The first is there has been zero coverage yet on this company. All the market knows is that another real estate company hit the public markets, and the coverage has been negative in the sense that it priced at the lower end of its IPO. This compares to other homebuilder IPOs earlier in the year that spiked right out of the gate. Again, I think this is partially timing related due to the interest rate spike and also due to the market not realizing that this company has the upside opportunity of a homebuilder without all of the legacy issues that others in this sector still carry. I fully suspect that when coverage is initiated on UCP it will be at a price point significantly higher than where the stock trades today, which leads directly into the second investment opportunity. This company owns a significant amount of land in relation to its market capitalization. It owns essentially zero legacy land positions, or those purchased before the housing crash that are still not yet fairly valued in many instances. The image below from the IPO prospectus shows the vintage year that the ~5,000 lots owned/controlled currently was acquired:

(click to enlarge)

You clearly see that over 80% of the current land holdings were acquired between 2008 and 2011, when the housing and land market was at its most depressed state. Investors have argued that land sitting on homebuilders' book is undervalued because GAAP accounting rules do not allow for land to be marked up to its fair value. In most cases, I disagree with this argument. In the case of UCP, because the company has to bare all as part of its prospectus and we can determine when its land was purchased, I fully believe that the land held on the balance sheet today is carried at a cost significantly below fair market value.

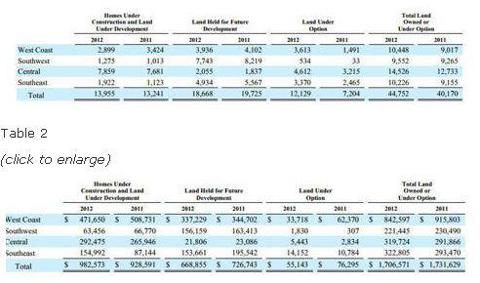

The table below from the prospectus filing shows the total lots owned and controlled by market:

(click to enlarge)

Again, there are multiple key takeaways from this table. First, we see that the company owns over 4,200 lots out of a total of ~5,000 lots owned/controlled. Owning over 80% of the lots the company controls means the company has physically already purchased the bulk of its lots, and will not be burdened with that cash outlay in the future. The company reported that its total value ascribed to real estate inventory (the bulk of which is land assets) was ~$140M at the end of the last quarter. If you exclude the controlled lots, which the company has very little investment in other than a deposit, you can see just how cheap the land is that the company owns. Using rough math, with $140M of real estate inventory divided by 4,255 owned lots (as seen above), the average value of a lot owned by the company is ~$33K. Just how undervalued these lots are becomes apparent when you view the following table from the KB Home (KBH) 2012 10-K:

(click to enlarge)

KB Home owned ~3,900 lots classified as land held for future development in its West Coast market, which is California. The carrying value of this land was ~$337M, which equates to over $85K per lot. This is land that KB Home does not intend to monetize within 12 months, in some cases because the land has just been acquired and needs to be developed. However, in most cases, this land is part of developments where the housing market has still not recovered to the point where it is economically feasible for the company to generate a return on these assets.

UCP owns lots in California with an average basis of $33K, and roughly 25% of those lots are already finished. In reality, as the finished lots carry a higher basis, the remaining 75% of owned lots are valued at even less than $33K on average. KB Home has lots in California valued at $85K that it cannot monetize today. Even if you think KB Home is overvalued, the discrepancy between the carrying cost for UCP land inventory shows just how undervalued the land holdings for UCP are.

Further evidence of how undervalued the land holdings are can also be found in the prospectus. Since 2008, UCP has sold ~950 lots and homes for just over $100M in proceeds. This works out to over $100K on average for each lot/home sold. The bulk of the transactions, ~850, were lot sales without a home. During Q1 2013, the company sold 54 lots at an ASP of ~$140K generating a gross margin on each lot of ~39%.

The Best Of Both Worlds

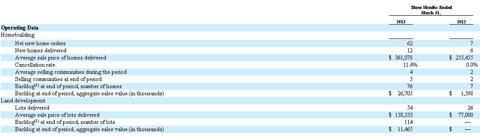

With the focus of not only growing a homebuilding operation, but also having the ability to generate revenue and profits through developing and selling lots, UCP is uniquely positioned in the real estate sector. The table below shows the operating results for Q1 2013 as shown in the prospectus:

(click to enlarge)

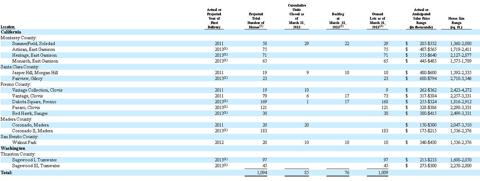

You will note that the company only had 5 communities at which it was operating its homebuilding operation at the end of Q1 2013. The following table shows just how explosive the homebuilding growth will be in the coming quarters:

(click to enlarge)

The above table shows that the company has over 1,000 lots, across 15 communities, which are or will be substantially developed and ready to open for sales by the end of 2013. The company ended the last quarter with 5 selling efforts, and that number is set to increase by over 200% in the near term. Here is where you will see explosive growth, albeit from a low level, in home closings and revenue over the next few quarters. With a homebuilding company, the operating leverage significantly increases in a situation like this where the entire portfolio of communities is closely concentrated in one geographic area.

The above table only shows 15 communities out of the 48 communities the company owns. UCP can selectively choose to either monetize its remaining communities by developing them and opening homebuilding operations or by selling them to other homebuilders. This is a luxury other builders do not have, in so much as they need to chase volume in order to support their cost structure.

Finally, UCP is unique in that after accounting for its ~$110M IPO proceeds net of costs and its cash on hand, it will have close to $120M at its disposal earmarked for growth. This compares to total debt of only ~$40M. The total market capitalization of the company is currently ~$255M. The net cash (cash minus debt) for UCP will be equal to ~31% of its total market capitalization. The book value for the company will be ~$225M after adding the IPO proceeds to the existing equity of ~$110M. This will give UCP a price-to-book value ratio of ~1.1x. This valuation, combined with the headline of substantial growth in the quarters to come, is what will drive the stock higher.

Investment Outlook

This is about as straight forward of an opportunity that you will find in the homebuilding and real estate industry today. The lack of coverage and fear regarding rising interest rates is creating an opportunity that will not last for long. In homebuilding, most valuation analysis centers around price-to-book value:

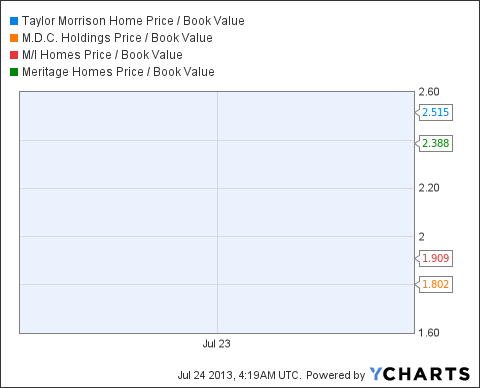

TMHC Price / Book Value data by YCharts

The above chart shows some of the more fairly valued homebuilders, as well as Taylor Morrison (TMHC), who just went public earlier this year. You will see that the lowest price to book valuation is 1.8x for M.D.C Holdings (MDC). Another California-based homebuilder which had its IPO earlier this year, TRI Pointe Homes (TPH), trades for greater than a 1.6x price-to-book value ratio.

The upside case here is simple. At a current valuation of ~1.1x its book value, UCP has more upside than any other publicly traded homebuilder. Further, the company has a cleaner balance sheet than any other builder and will face far less downside in the risk of a correction. With a small operation, entailing minimal overhead and carrying costs, UCP does not face the risk of getting caught with overvalued land assets. Remember, over 80% of the land assets the company owns today were purchased between 2008 and 2011. Compare that to the other homebuilders today buying land left and right, at a time when land prices have soared as the housing market has recovered. As the market realizes the opportunity, and the significant risk/reward profile of this company, I feel that UCP has at a minimum 50% upside before its price-to-book valuation is even at a remotely reasonable level. If the company executes on its expansion plans and grows its community account swiftly, the upside could be over 75% before UPC reaches a valuation of 2x its book value.

Opportunity is knocking, answer the door.

Source: (All UCP related financial information is sourced from the Prospectus filed with the SEC in conjunction with the recent IPO)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Tate Stevens Miss Universe 2012 x factor x factor eastbay Samantha Steele Dec 21 2012

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.