Lucky are those who are flush of liquidity with money stuffed in their bank accounts. Perhaps they don?t realise the idle fire power in their bank accounts which many would be dying to have. So many people either end up taking wrong financial decisions by either selling their revenue earning assets or taking up costly financial help just to raise short to long term loans to fund their investment or consumption requirements. The after maths of these decisions are multi dimensions, to name a few : - Selling off an existing assets / investments at harsh valuations to raise up instant liquidity. Remember that if you want instant liquidity on your investments, the chances of you getting a fair price for them is remote. For example, selling your real estate at a discounted value or selling your stocks / mutual funds at poor value.

- Selling off an existing assets / investments at harsh valuations to raise up instant liquidity. Remember that if you want instant liquidity on your investments, the chances of you getting a fair price for them is remote. For example, selling your real estate at a discounted value or selling your stocks / mutual funds at poor value.

- Tax Nightmares ? How many of you care of tax impact when you need liquidity ? The impact can eat any where from 0-30% of your asset value. For example, selling your mutual funds before 1 year can result in 15% tax on your gains. Or selling your real estate before 3 years could end you paying 30% tax on the gains (if you end up having one).

- Financial Damage ? Selling one asset for buying another asset is not a good idea in a lot of cases, unless your existing asset has been wrong investment decision. I at times call it selling your mum?s jewels to buy jewels for your wife (or vice-versa) ! This also ends up denting your financial plan which you may have been following for several years towards your goal. I have so often seen people investing for years into a retirement pot like PPF or mutual funds which gets an axe to fund their other investment decisions. Unfortunately some of these pots can not be re-filled instantly or you could end up paying more to fill the same level of your pot.

Perhaps this is enough of an introduction trying to justify that knowing different sources of funding is really helpful as it may help in furthering your investment objective without axing your existing net worth. This article is going to enumerate of a few of such options which you may want to utilise depending upon your requirement.

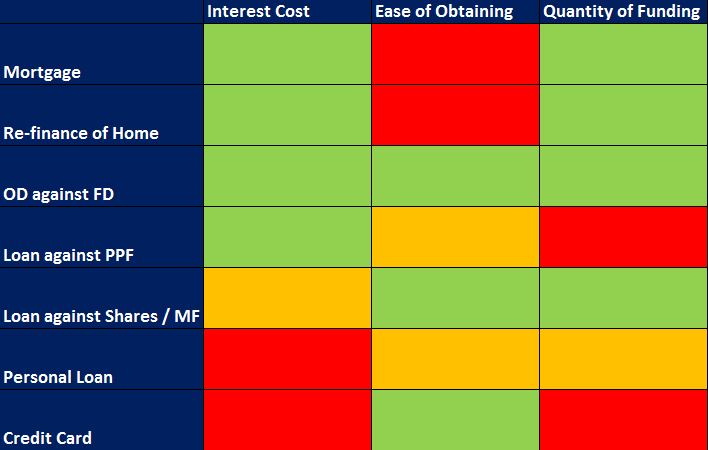

Before we start going into each of the funding options available at your disposal, I have summarised each of these options and their relative colour score for each of the category.

For Interest Costs, a Green indicates reasonable interest rate cost, Orange indicates high interest rate and Red indicates very high interest cost.

For Ease of Obtaining ? Green indicates that a loan is easy to obtain, Orange means a bit tedious to obtain and Red means ? different to obtain & involving a lot of paper work.

For Quantity of Funding ? Green indicates that a large amount of loan can be obtained as loan, Orange means medium amount of funding can be obtained and Red means low level of funding can be obtained.

?

Housing Loan

Most of the times your requirement for funding is to support a decision to buy a property and it is very commonly known that the best way to finance your residential property decisions is via a Mortgage or commonly known ? Home Loan. Banks are happy to give this form of funding subject to a few boundaries such as :

- Between 80 to 85% of the value of property (also called Loan to Value). So if you want to buy a property worth 50 lacs, banks can provide a home loan upto 42.5 lacs.

- Your earning potential ? Different banks have different?criteria and?banks are restricted in their loan?decisions?to fund only upto x times of your annual income. This x can be any where from 5-20 times of your income and depending upon the respective banks. And unfortunately this is calculation is based upon your income declared in your annual income tax returns.

- Type of property ? banks don?t fund every type of property, specially when it comes to disputed title, flats, etc. Hence your property should be within the eligible types of properties which it can sponsor.

Interest rates on housing loan are amongst the lowest you can get. At the time of writing this article, they are around 10-12%. As the interest rates in the economy move, they can be any where from 8% to 14%. To a person outside India it would sound a rip-off as mortgage rates in Western Countries are between 2-5%, but unfortunately India doesn?t have that luxury.

Paper work ? Home loans may not be very easy to get as the banks need to do a lot of due diligence on the property, income affordability, obtaining a charge on the property and legal paper work. Hence at times it may take from a couple of weeks to several months before your loan gets sanctioned and disbursed.

?

Remortgage / Re-finance of Home Loan

Not many people know about this type of financing facility. People are aware that they can take a home loan to purchase a property. However, you can also obtain a loan against your existing property of which you are already an owner. Hence this option is called Remortgage or Re-finance of Home. By using this mode of finance you can arrange large amount of liquidity against your illiquid residential properties at low levels of interest rates.

The criteria applicable for Home loan as mentioned in first option are exactly applicable for Re-mortgage. The interest rates can be same or slightly higher than home loans (between 0.5-1% more than home loan) ? again it depends upon the lending banks.

?

Loans Against Fixed Deposits This is yet another unexplored area where cheap finance can be raised on a short notice. If you look at it, your balances lying in your Fixed Deposits are essentially your money which you can?t access till its maturity or without breaking the deposit account. Loan against FDs effectively works like an overdraft account which is secured against your FD balances. Banks can provide upto 90% loan on the FD amount as an OD facility which can be withdrawn at no notice. Interest is charged only on the withdrawn amount. For example, if you have FD?s worth Rs. 30 lacs, you can get OD against this FD balance for upto 27 lacs. If you don?t withdrawn any amount, no interest will be charged. If you withdraw only 5 lacs of the available 27 lacs, bank will charge interest on only 5 lacs. If you repay back Rs. 5 lacs after a month, the interest will be charged only for a month and you can again have the entire 27 lacs at your disposal when needed. Even if you want to use it for a couple of months / years, all what you need is to pay the monthly interest amount to the bank.

This is yet another unexplored area where cheap finance can be raised on a short notice. If you look at it, your balances lying in your Fixed Deposits are essentially your money which you can?t access till its maturity or without breaking the deposit account. Loan against FDs effectively works like an overdraft account which is secured against your FD balances. Banks can provide upto 90% loan on the FD amount as an OD facility which can be withdrawn at no notice. Interest is charged only on the withdrawn amount. For example, if you have FD?s worth Rs. 30 lacs, you can get OD against this FD balance for upto 27 lacs. If you don?t withdrawn any amount, no interest will be charged. If you withdraw only 5 lacs of the available 27 lacs, bank will charge interest on only 5 lacs. If you repay back Rs. 5 lacs after a month, the interest will be charged only for a month and you can again have the entire 27 lacs at your disposal when needed. Even if you want to use it for a couple of months / years, all what you need is to pay the monthly interest amount to the bank.

The interest rate charged by the banks is generally between 0.5% ? 1% higher than your FD rate. For example, if your FDs are attracting 9% interest, the OD shall rate shall be between 9.5%-10%. Another advantage of this facility is that there would be no processing charges payable by the borrower, which saves you another 0.5%-1% of the loan amount. So this may be even cheaper than a home loans and can be a very effective financing option for all NRIs who have stashed millions of rupees in their NRE Fixed Deposits.

?

Loan against Securities

If you have stocks / mutual funds, you do not need to sell them in order to get liquidity. Banks provide loan facility against your stocks and mutual funds. You can pledge your holdings to the bank and against that the bank will provide you an OD facility. The type of securities against which you can generally avail such kind of credit facility are shares held in demat form, mutual fund units, Exchange Traded Funds (ETFs) and Insurance Policies.

Unlike loan against FDs, banks would generally charge a processing fees along with an annual fees to renew the OD. Also the interest rate will vary based upon type of security. Generally you can expect the bank to charge around Base Rate plus 3-6%. The base rate at time of writing this article is around 9.5-10%. So in effect you can expect anywhere between 14%-16% interest rate being charged against your securities.

?

Loan against Gold Indians love investing in Gold ? which can be in the form form of gold jewellery or buying physical gold coins or bars. Our trust in gold has been passed on from generations and is difficult to be uprooted. The only disadvantage is that this gold gets passed on from one generation to another and is rarely be sold. Hence any capital invested in the asset along with capital gains there on are just notional as they will never be monetised. Gold loans tend to ease this problem by providing credit facility upto 70-80% on the value of gold. Again this facility can be obtained in the form of an Overdraft account secured by your gold holdings. You need to take your gold jewellery / coins to the respective bank who would perform its valuation and subsequently accept it as a pledge. The processing fees on such loans can be around 1-1.5% of the value of the desired loan. Interest rate is slightly cheaper than loan against securities and could cost between 13-16%. Beware before you contact any gold finance companies (non Banks) ? they would charge over 20% interest against your gold !

Indians love investing in Gold ? which can be in the form form of gold jewellery or buying physical gold coins or bars. Our trust in gold has been passed on from generations and is difficult to be uprooted. The only disadvantage is that this gold gets passed on from one generation to another and is rarely be sold. Hence any capital invested in the asset along with capital gains there on are just notional as they will never be monetised. Gold loans tend to ease this problem by providing credit facility upto 70-80% on the value of gold. Again this facility can be obtained in the form of an Overdraft account secured by your gold holdings. You need to take your gold jewellery / coins to the respective bank who would perform its valuation and subsequently accept it as a pledge. The processing fees on such loans can be around 1-1.5% of the value of the desired loan. Interest rate is slightly cheaper than loan against securities and could cost between 13-16%. Beware before you contact any gold finance companies (non Banks) ? they would charge over 20% interest against your gold !

?

Loan against PPF

This mode of obtaining a loan is a bit lower in my priority, but it is good to know that it exists. A lot of restrictions exists around this and the key ones are :

1. You can get a loan after the end of first fiscal year when you started your PPF account and before 5 fiscal years. For example, if you opened your PPF account in Dec 2011, you cannot obtain a loan against your PPF balance before March 2013. Further, you can only obtain a loan upto 2017.

2. The amount of loan can not exceed more than 25% of the balance of the last fiscal year.

3. Interest rate is 2% over the PPF rate. Currently this will be 10.6%

4. You need to repay the principal within 36 months and interest due on the amount within next 2 months after the end of 36 months. If you don?t do this, the interest rate will increase by 4% to 14.6%.

I believe that the maximum amount which you possibly borrow from a PPF account owing to such restrictions can not be large. Even if you deposit 1 lac each year, the max you can draw as a loan will never be more than 1 ? 1.5 lacs in total.

?

Personal Loan

If all of my modes of financing have been exhausted, I would perhaps looks towards financing via Personal Loan from a bank. Caution - this option is amongst the most expensive option and in most cases charges a prepayment penalty in case you want to settle this loan early. The interest rate offered by banks depends upon the credit worthiness of the borrower and can range from any where between 18% to 50%. This form of financing is not secured on any of your assets and is provided very rapidly by the banks. But again, beggars can?t be choosers. If you really need funding and you don?t have other options, then this is the option which may come handy. But before that do not forget that an equally competitive loan source can be your credit card !

?

Credit Cards This option is not very commonly used in India as credit cards have not penetrated deep into Indian consumer?s hand. To some extent I might call it good considering it has burnt a lot of people who have used it incorrectly without knowing the fine prints. Credit cards offer an individual ready access to cash upto the cash withdrawal limits. Your limit can vary from one bank to another and can be between 50-80% of your overall credit card limit. The interest charged on credit cards is between 2-5% monthly. On an annual basis this is a whopping 24-60%. However, this facility can come up very handy where you may need cash for just a couple of days to bridge your funding gap. However, never aim to use this form of funding for over a couple of months as it would dent your finances very adversely owing to hefty interest charges.

This option is not very commonly used in India as credit cards have not penetrated deep into Indian consumer?s hand. To some extent I might call it good considering it has burnt a lot of people who have used it incorrectly without knowing the fine prints. Credit cards offer an individual ready access to cash upto the cash withdrawal limits. Your limit can vary from one bank to another and can be between 50-80% of your overall credit card limit. The interest charged on credit cards is between 2-5% monthly. On an annual basis this is a whopping 24-60%. However, this facility can come up very handy where you may need cash for just a couple of days to bridge your funding gap. However, never aim to use this form of funding for over a couple of months as it would dent your finances very adversely owing to hefty interest charges.

?

Conclusion

Among all the options which I have mentioned in this article, you should evaluate your personal circumstances and choose the one which is most appropriate to suit your needs. Try to go with the secured loan options such as Home Loan or Loan against FDs (if you have FDs) which will take some time before getting sanctioned, but they will cost you less. Unsecured loans such as Personal loans and credit cards can cost as much as the lender wants. Hence avoid such financing options unless you are really stretched. In the end, no loan is a good loan ? you may also enjoy reading our article Good Loan & Bad Loan.

Related Posts:

Source: http://insight.banyanfa.com/options-to-raise-funding/

gavin degraw gavin degraw alec time 100 bob beckel anna paquin warren buffett

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.